For most entrepreneurs, being a business owner means wearing numerous hats throughout the day. The last thing you’re looking to do at the end of a busy day is to sit down and update your financial records. It’s pretty much the WORST. But, whether we like it or not, keeping up with the financials is crucial to running a successful small business. Brendan Norton, the owner of Norton Financials, a local Hoboken accounting and bookkeeping firm for small businesses, has come up with a few tips to help you stay on top of your business financials so that you can focus on what’s important: your business. Here are five things a bookkeeping service can to to help you keep sane and focused on the growth of your small business.

1. Keep up with your bookkeeping tasks.

It’s very easy to let time pass without formally updating and organizing your financial records. After all, entering transactions in QuickBooks, reconciling bank accounts, and organizing your payables is a tedious task that takes time.

What that means: According to Brendan, devoting 2-5 hours per week on these tasks will do wonders for your business in the long-run in terms of organization and tax prep. A bookkeeping service can help with all of these things.

2. Constantly review business performance

If you’re able to keep up with the day-to-day bookkeeping, then summarizing your business financials on a monthly basis is a piece of cake.

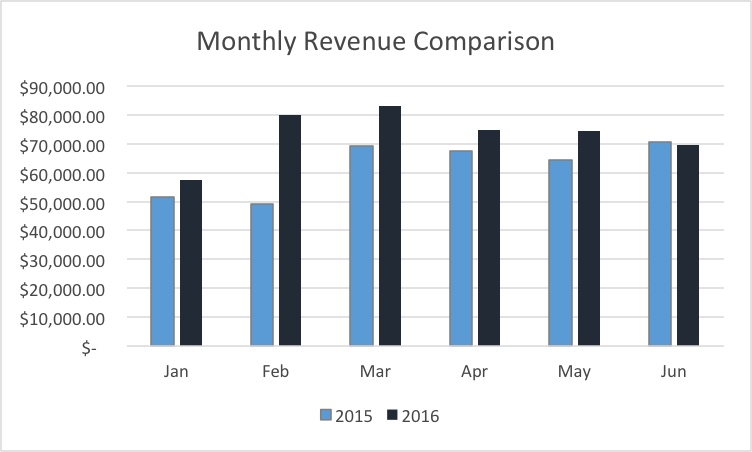

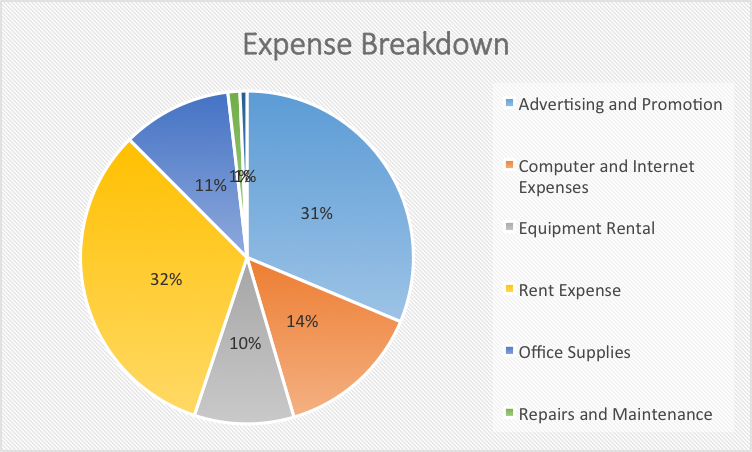

What that means: Most of the time, it’s a matter of exporting QuickBooks data to Microsoft Excel so you can analyze performance. Once the data is in excel, you can use visuals such as pie charts for identifying the main expenses and bar graphs to compare sales performance over time.

3. Meet with a financial professional at least once a quarter.

Quarterly financial meetings help business owners reiterate their financial goals and evaluate their progress. Financial professionals can use your data to help you gain clarity into the performance of your business.

What that means: Their expertise will help you gain valuable insights about the financials of your company. In addition, meeting with a professional will help improve accounting techniques, as well as help identify areas to invest and improve your business.

4. Create a weekly payables list.

Create a weekly payables list that includes outstanding/current/upcoming payables by due date, amount, check number and vendor. This simple process will make life much easier in terms of organizing and understanding upcoming and past due expenses.

What that means: This process also helps to plan for large upcoming expenses as you are more aware of any expenses due in the next few weeks. It’s also beneficial to cross off checks that have already been paid from this list so you can tell how many checks you’ve sent out. This will help you manage your cashflow by eliminating the need to guess which checks are still uncashed.

5. Utilize technology

One of the best ways business owners can save time is by utilizing technology. Systems such as Quickbooks have numerous features that are intended to make life easier for small business owners.

What that means: For example, Quickbooks allows users to link bank accounts to avoid the tedious tasks of manually entering each debit and credit transaction your business generates. Instead, it allows you to view all transactions in a queue and confirm or deny the entry. This is also a more accurate approach as it eliminates the risk of human error (fat fingering entries).

While you can do many of these things to help stay on top of your financial goals, it’s important to rely on a professional to make sure that everything is squared away and in good standing {especially when tax season comes around!}. For help with your small business’ local accounting and bookkeeping services, contact Norton Financials {201.855.6344 or email BNorton@NortonFinancials.com for an assessment of your business’ needs}. You definitely won’t regret it!

*This is a sponsored post.