In an unexpected ruling several weeks ago, New York announced a ban on broker fee charges for renters. Prior to the ban, New York City renters were expected to work with a broker, who, according to the New York Times, pockets as much of 15% of the renter’s annual lease. Now, rental commissions are back thanks to a New York judge granting a temporary restraining order that bars the order from going into effect.

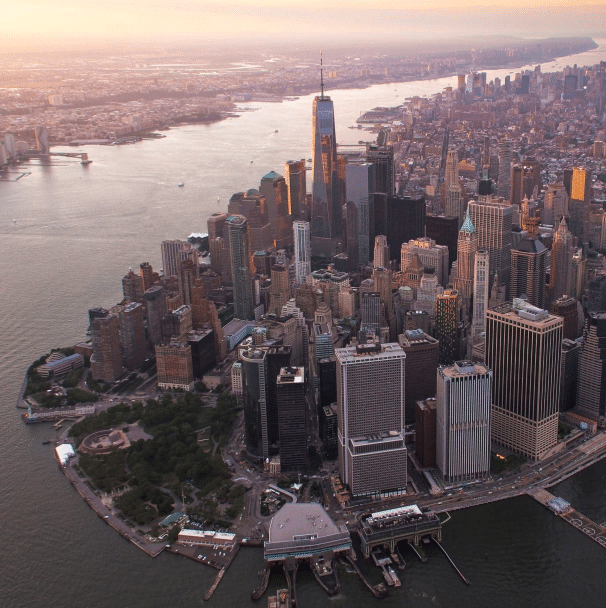

The initial ruling was shocking for nearly everyone in the Tri-State area, and now many people who live in Hoboken, Jersey City, and the surrounding Hudson County area are wondering what a potential slash in broker fees might mean for New Jersey as well. After all, whenever New York does something, New Jersey generally follows suit — at least historically.

The Details of the Original Ban

According to the original NYT article, “In an unexpected addendum to last year’s rent laws, state housing regulators said renters can no longer be charged broker fees, potentially upending the market and delivering the latest blow to an industry already reeling from new regulations and sweeping tenant protections.”

So, what does this addendum actually mean? Hoboken Girl consulted a few local real estate agents to fully understand the addendum. According to Todd Maloof, sales partner at PRIME Real Estate Group, “The addendum, as the way I understand it, means that homeowners are no longer allowed to pass through brokerage costs to potential tenants when they look to move to a new rental.”

Ed Verdel, owner and broker at Verdel Real Estate, explains, “Originally there was no limit on broker fees, and the standard was for the tenant to pay anywhere from one month [rent] to 15% of an annual lease. Security deposits were unlimited for market-rate apartments, but the common amount taken was anywhere from 1.5 to 2 months.”

“Rental applications were hefty, sometimes as high as $2,000,” Verdel adds.

But now, it appears that the ban is on hold, at least for the time being. According to Curbed NY, a judge has temporarily blocked the new state addendum barring brokers’ fees for tenants. The order comes after the Real Estate Board of New York and several big-name brokerages filed a lawsuit in Albany County Supreme Court against the rule change.

Read More: What to Know + Ask When Looking for a High-Rise Home

How The Ban Would Work, Hypothetically

Essentially, it means that renters are no longer required to pay brokers. However, brokers have to get paid, right? The responsibility for paying brokers would then fall on whoever hires the broker. So, if a landlord hires a broker to find someone to occupy the space, the landlord pays the broker. Alternatively, if a renter hires a broker, then they still are responsible for paying the broker.

“If the property is listed by an agent representing the landlord, then the landlord must pay that agent,” Verdel noted. “So if a renter goes directly to the landlord’s agent, the renter will not have to pay a fee. However, if a prospective renter reaches out to an agent for help with seeing apartments and seeks tenant representation {someone to show them multiple apartments}, then that agent can charge a fee for their services.”

Because most of the payment of brokers falls in the laps of landlords, the new regulation has proven controversial to many, brokers and landlords included.

This 2020 adaption is an addendum to the Statewide Housing Security + Tenant Protection Act and the Housing Stability + Tenant Protection Act, both passed in 2019. According to NBCNY, these Acts also state:

- Landlords are prohibited from collecting application fees greater than $20, unless provided for by law or regulation

- Application fees are waived if a background or credit check provided by the potential tenant was conducted in the past 30 days

- Landlords are restricted from charging late rent fees “unless payment of rent has not been made within five days of due date”

- Late rent fee penalties cannot be more than $50 or 5% of monthly rent, whichever is less

- Safety deposits are to be returned within two weeks after tenant has left the apartment

- No deposit or advance for a unit can add up to more than one month’s rent; the landlord cannot request an additional security deposit for either pets or move-in expenses

If this change were to go into effect, Steve Salzer of Keller Williams City Life Realty believes it would cause a ripple effect of changes to the real estate industry.

“A change of this significance will have several impacts that I can think of and I’m sure many more that I haven’t considered yet,” says Salzer. “In the short term, landlords may take a hit or choose to forgo hiring an agent. In the long term, I expect rents and the monies previously spent by tenants on fees will get absorbed into rents wherever possible. Over time a rise in rents to offset landlord-paid fees will actually hurt tenants who stay in apartments for more than a year or two since the higher rent will be collected every month long after the dollar average savings of not having been exposed to the fee has been offset.”

Marco Tartaglia, the managing broker at PRIME Real Estate Group, says the addendum will only cause tenants to have higher rents. In fact, before the industry filed an Article 78 petition on February 10th, Tartaglia predicted the addendum would be legally challenged.

“Real estate agents are offering a service and deserve to be paid for that service,” Tartaglia says. “If the fees we are allowed to charge are taken away, the landlord will be responsible to cover this fees and marketing costs which will, in turn, be passed along to the tenants with higher rents.”

Tartaglia adds, “I personally think these new policies will be challenged in the courts as I do not see how local government can stop anyone for charging for their services in a Democratic [and] capitalist society.”

See More: 10 Easy Upgrades to Make Your Hoboken Rental Feel Like Home

What this Means for New Jersey

Of course, New Jersey has a different set of rules. At least for now. Here are what several brokers locally had to say:

“New Jersey’s laws are different, and here in Hoboken and Hudson County, the broker fees are traditionally paid by the tenants. Our fee structure is also different where apartments with broker fees equal one month’s rent,” explained Maloof. “So that same apartment that costs $3,000 a month to rent, will only be an additional $3,000 in broker fees. Sometimes landlords offer incentives to share that fee with the tenants to make their apartment more attractive during the offseason, however, it’s fairly common among rentals that are listed with a realtor here in town.”

So, what could the addendum potentially mean for Hoboken and other New Jersey areas close to the city — should it eventually go into effect?

If New Jersey were to follow in New York’s original ban footsteps, it could mean that like NY, renters would no longer be responsible for paying brokers {unless the renters themselves hired the broker}.

Like NY regulations, if changed, then New Jersey law would require whoever hired the broker to issue payment. But for now, a change in New York broker fees could make cities in close proximity to the city more populated.

“The most common opinion I’m hearing is that if the landlords have to pay more fees, then they will pass on most of the additional expenses on to tenants, therefore causing rental prices to increase in NY,” Verdel explains. ” This would only make Hudson County more desirable for NYC commuters and would draw more tenants across the river…another reason why I don’t see fees here changing.”

Ultimately, Verdel thinks if New Jersey also issued a similar addendum, it could mean a big shift in the industry.

“If NJ passed a law not allowing agents to collect a broker fee from tenants, I can see a lot of agents leaving the industry,” Verdel explains. “There are plenty of agents that rely on tenant representation as their main source of income. Personally, I always prefer for a landlord to pay broker fees. It’s that way in most of the country and I believe that [the] model makes the most sense.”

If you’ve ever gone apartment-hunting in Hoboken, then you know all too well how tricky it can be to find a place — with or without a broker.

As it stands now, most Hoboken apartments have a one-month broker fee that’s equivalent to one month of rent, with Jersey City having a similar situation for the most part. Unless you find a rental specifically designated “no fee,” then there’s a broker fee. In addition to the broker’s fee, most apartments also require 1.5 months security deposit.

It’s a developing story, and with the current restraining order on the ban, there may be more updates to come. We’ll keep you posted as the story unfolds.

Got a news tip or update for this article?

Let us know — email us at hello@hobokengirl.com! We appreciate it.

Did you know: We started a podcast about all things news and lifestyle in Hoboken + Jersey City!

Listen to the latest episode of Tea on the Hudson here and subscribe.

We release new episodes every Tuesday!